Here are the steps to file an ITR Return

Olga DeLawrence

Olga DeLawrence

Confused about filing an Income Tax Return? Read below!

How to file income tax return (ITR) step by step:

-

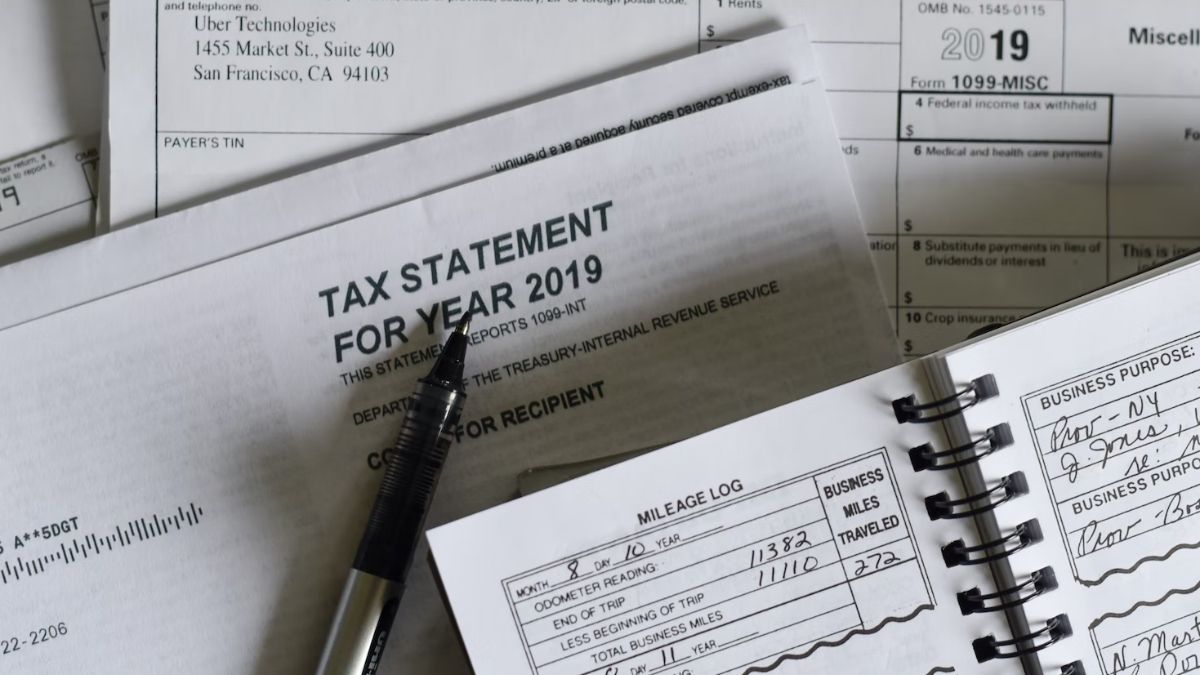

Get Necessary Paperwork

Relevant paperwork should be close at hand to access any information about the tax deducted at source (TDS) from the income and the gross taxable income. A list of documents to refer to may include:

- Form-16

- Interest income and TDS certificates/Form 16A from banks and post office

- TDS certificates from other incomes

- Form 26AS

- Tax-saving investment, expenditure proofs

- Capital gains

- Aadhaar number

- Details of investment in unlisted shares

- Bank account details

-

Check Form 26AS and/or AIS

Form 26AS contains all the information about the taxes that were withheld from the earnings. Ensure that the tax withheld from the incomes—such as salary, interest, etc.—is deposited with the government and charged against the PAN. Compare the TDS certificates with Form 26AS.

-

Address the errors on Form 26AS

Claim for any credit for the tax that was subtracted cannot be made if the error or inaccuracies shown in the TDS certificates (Form-16, Form-16A, etc.) and Form 26AS differ.

-

Calculate the overall earnings for the fiscal year

Determine the total income by summing the earnings from the five separate heads, taking all the appropriate deductions permitted by the Income Tax Act.

The former income tax regime permits deduction claims which are not so in the case of the new tax system.

-

Calculate Payable Tax

Tax payable could be determined by using the tax rates in effect for that fiscal year according to the income slab after calculating the total income.

-

Determine Due Tax

Deduct the taxes already paid through TDS, TCS, and advance tax during the year after calculating payable tax in the previous step. Include any interest due under Sections 234A, 234B, and 234C.

-

File Tax Return

File the ITR once any taxes that may still be owed have been paid. Any refund from the tax department can be claimed provided the ITR has been filed. Use the correct ITR form while filing since submission through an incorrect form is invalid.

-

ITR Verification

ITR can be verified in six different ways, out of which one can be done physically. To return in person, a properly signed copy of ITR-V/Acknowledgement needs to be posted to the following address: CPC, Post Box No. 1, Electronic City Post Office, Bangalore, 560100.

-

Acknowledging e-verification

The tax department will immediately confirm that the ITR has been verified if the electronic method has been opted. If ITR-V is sent to the I-T department via postal mail, they will email confirming receipt and confirm the return to the registered email address.

-

IT Department Desk

Post verification, either physically or electronically to check for any inaccuracies and in compliance with the IT Act, the tax return will be processed. Cross-checking the information provided with other data that is associated with the return also happens.

The I-T department will notify you through email to the registered email ID once the return has been processed.